per capita tax in pa

A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district. If you pay your bill on or before the discount date in September you receive a 2.

Maptitude Mapping Software Map Infographic Of Turkeys Raised By State Map Mapping Software Infographic

Do I pay this tax if I.

. Act 511 Taxes for Pennsylvania School Districts Glossary of Terms. Act 511 of 1965. The Arnold per capita tax is 20 with 10 paid to the city of.

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. This tax is due yearly.

Motor and Alternative Fuel Taxes. Per PersonPer Capita taxes Issued to any person age 18 or older who resides in the Phoenixville Area School District. Pennsylvania has a flat 307 percent individual income tax.

Per capita taxes are levied. It is not dependent upon employment. What is per capita tax in PA.

The application form may be used by a PA taxpayer whose community has adopted one or. Per Capita means by head so. City Per Capita Taxes are based on a calendar year from January 1 thru December 31 of the current year.

Per Capita means by head so this tax is commonly called a head tax. The Per Capita Tax bill is sent in July. For most areas adult is defined as 18 years of age or older.

PA State Law requires counties to maintain a personalper capita tax roll that lists all individuals by their job title occupation and assessment. Sales Use and Hotel Occupancy Tax. Normally the Per Capita tax is NOT withheld by your employer.

The City of Reading located in southeastern Pennsylvania is the principal city of the Greater Reading Area and the county seat for Berks County. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Business Gross Receipts Tax.

Earned Income Tax Regulations. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district. Per capita exemption requests can be submitted online.

For most areas adult is defined as 18 years of age and older. Act 511 Taxes Flat Act 511 Taxes Proportional Amusement Tax. This tax does not matter if you own rent or have a child attending the.

Links for Individual Taxpayers. Who owes per capita tax. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing.

With an estimated population of 95112 as. FAQ for Individual Taxpayers. There are also jurisdictions that collect local income taxes.

If your income changes you move out of Antis Township or you have any questions about the Per Capita Tax please contact the elected tax collector. Per capita only discount through August. It can be levied by a municipality.

It is not dependent upon employment. What is the Per Capita Tax. Dauphin County - Upper Dauphin Area School District Occupation and Per Capita Tax Payments.

Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. ACT 511 Tax is a Per Capita Tax that can be levied at a maximum rate of 1000. Per Capita Tax Roll.

This tax has no connection with employment income voting rights or any other factor except residence with Arnold city limits. Pennsylvania has a 999 percent corporate income tax rate and. Access Keystones e-Pay to get started.

What is difference between an ACT 511 and ACT 679 Per Capita Tax. Each resident or inhabitant over eighteen years of age in every school district of the second third and fourth class which shall levy such tax shall annually pay for the use of the. The list must also include.

Who owes per capita tax. Section 6-679 - Per capita taxes. The per capita tax is usually a fixed amount charged annually to each adult residing within the taxing district.

For most areas adult is defined as 18 years of age and older though in. Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. What is per capita tax.

Individual Taxpayer Mailing Addresses. What is the Per Capita Tax.

Tax Burden By State 2022 State And Local Taxes Tax Foundation

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Retirement Locations Map

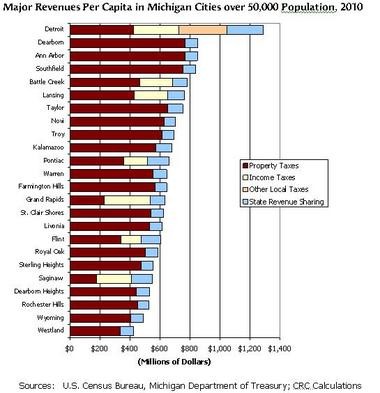

Analysis Detroit Enjoys Highest Per Capita Revenue In State Thanks To High Diversified Tax Rates Mlive Com

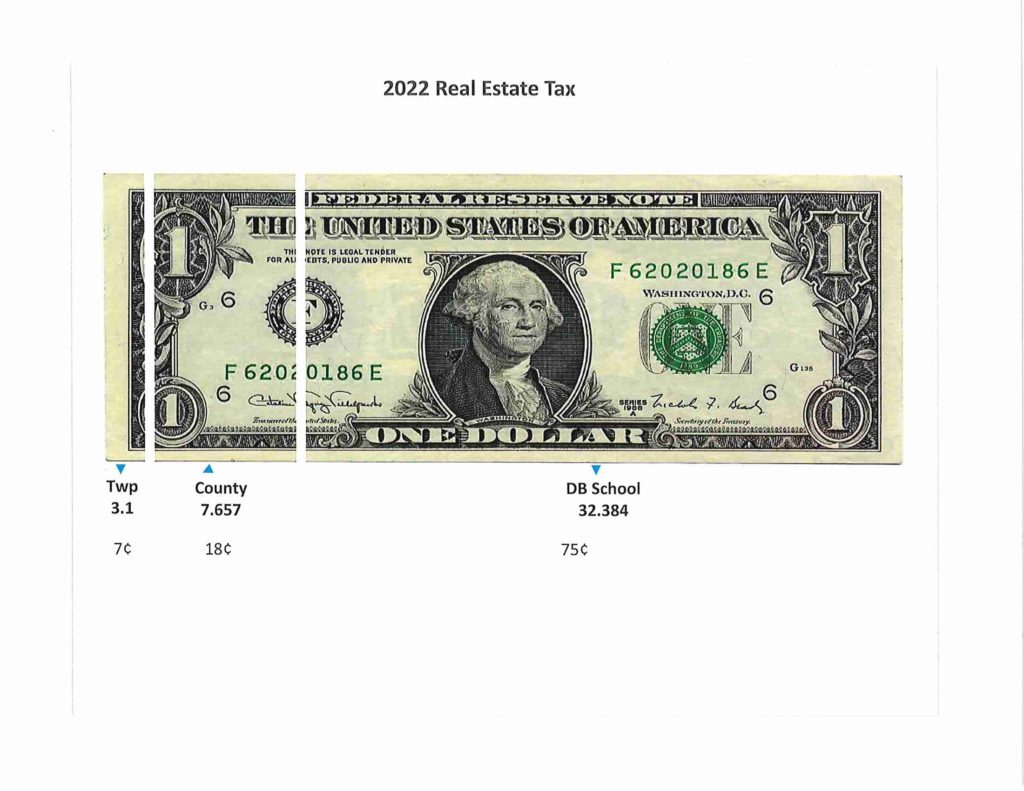

Real Estate And Per Capita Tax Wilson School District Berks County Pa

Rockland Township Venango County Pennsylvania Wikipedia Venango County Pennsylvania

City Of Monongahela Tax Information

Per Capita Tax Exemption Form Keystone Collections Group

How Much Income You Need To Afford The Average Home In Every State The Housing Market Has Not Only Infographs Housing Investi Map Usa Map 30 Year Mortgage

Per Capita Tax Exemption Form Keystone Collections Group

Per Capita Tax Exemption Form Keystone Collections Group

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation